Putting Helen Ventures on the European VC map

Several media outlets in the venture capital ecosystem have been reporting about the 2021 European Capital Report by i5invest and WU Entrepreneurship Center. We at Helen Ventures are delighted that also our work has been recognised in the report!

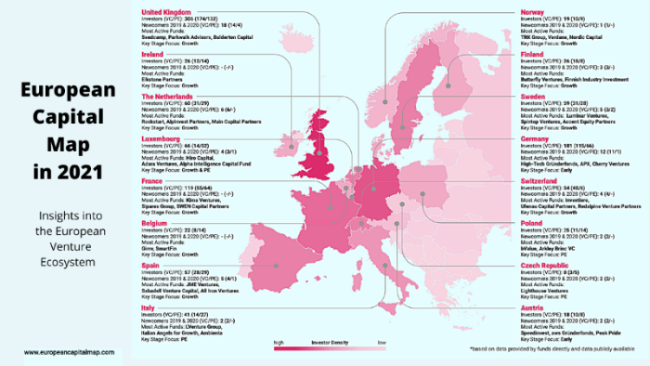

The European Capital Report is a cross-section of the European venture capital ecosystem at the start of the year 2021. The report promises to present all VCs & PEs that you should have on your radar in Europe.

For us, this is a relevant scope, because Helen Ventures invests in the most innovative and transformative European energy-related startups, and actively looks for coinvestors. So far, we have made investments in Finland, Germany, the Netherlands and Norway with coinvestors from around the continent.

Image source: The 2021 European Capital Report

New kids on the block

According to the European Capital report, there were three newcomers in Finland in 2019–2020. One of these new investors is us, Helen Ventures, and the others are Nordic Ninja and Voima Ventures.

European-wide, 64 funds were established over the last two years according to the report. Among these new funds four are corporate venture capital (CVC) funds: Helen Ventures from Finland, Smart Works from Austria, Sparrow Ventures from Switzerland and DNV GL Ventures from Norway.

According to the report, there are 55 CVCs in Europe, with 18 in Britain, 16 in Germany and 6 in Switzerland. Top investment sectors for CVCs are AI and Big Data, Industry 4.0, life science and HealthTec, Software as a Service (SaaS) and transport.

Helen Ventures focuses on e-mobility, renewable energy technology, smart energy solutions, distributed energy solutions, circular economy and decarbonisation, and digital solutions applicable to the energy sector.

The Finnish statistics

According to the report, there are 26 VC investors in Finland with focus on the growth stage.

The most active funds in Finland in 2020 according to the report were Butterfly Ventures (our coinvestor in the Norwegian startup Think Outside) with 29 investments, Finnish Industry Investment (TESI) with 23 investments, and Inventure with 12 investments.

Helen Ventures made two investments in 2020 and launched the year 2021 by announcing a new investment. Now we have four startups in our portfolio.

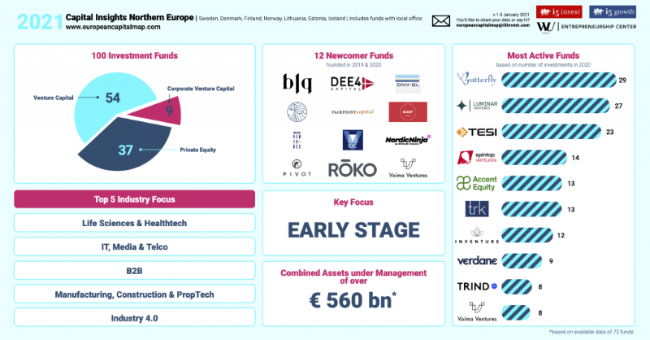

Image source: The 2021 European Capital Report

Investors to watch in Northern Europe

For those interested in statistics, the listing of the most powerful investment funds in Northern Europe is interesting reading. The listing covers investors in Sweden, Denmark, Finland, Norway, Lithuania, Estonia, Iceland and Latvia.

The first list includes Top 10 VCs based on assets under management

- Novo Holdings

- Verdane

- EQT Ventures

- Industrifonden

- Investinor

- Heartcore Capital

- Almi Invest

- Inventure

- Equinor Ventures

- Hadean Ventures

The second list outlines the top 10 PE based on assets under management

- Nordic Capital

- Kinnevik

- Altor Equity Partners

- HitecVision

- Cubera

- CapMan

- FSN Capital

- Finnish Industry Investment (Tesi)

- Summa Equity

- Norvestor

In total, there are 100 investment funds in Northern Europe, the report says. Nine of them are corporate venture capital funds like Helen Ventures, 54 VC funds and 37 PE funds. Combined assets under management are 560 billion euros with focus on the early stage.

Helen Ventures invests 50 million euros in early and growth stage companies. We can accelerate the growth of startups through our profound energy market insights and by collaborating with our customers and industry experts.

Sources: 2021 European Capital Report, Sifted, Growth Business

Do you have a promising idea and an excellent team? We are interested in hearing about you!

Drop us a line: hello@helenventures.fi